The innovative advisory boutique for corporate transformation processes and competition proceedings.

Based in Berlin,

rooted in Europe,

working globally

From experience – as monitoring trustees, advisers or executive managers – we know how to make complex transformation processes happen and how to smoothly implement complex remedies, without disruptions to our clients’ operations.

DAVID CAYET

a French and German national, has been managing complex M&A, transformation, restructuring and remedy implementation processes for large and medium-sized US and European corporates for 30 years – as a monitoring trustee, banker, adviser or CFO.

ULRICH PULS

a German national with global experience, has been a monitoring trustee, corporate finance adviser, CFO and economics consultant, advising private and public sector clients on international transactions, remedy implementation and public tenders for almost 30 years.

Our Services

Think straight,

talk straight.

Grounded on decades of experience as monitoring trustees, investment bankers, economics advisers and executive managers, ALCIS offers a unique, boutique approach dedicated to its clients’ success: hands-on, pragmatic monitoring of complex corporate transformation processes, delivered by seasoned professionals with strong mediation capabilities.

Grounded on decades of experience as monitoring trustees, investment bankers, economics advisers and executive managers, ALCIS offers a unique, boutique approach dedicated to its clients’ success: hands-on, pragmatic monitoring of complex corporate transformation processes, delivered by seasoned professionals with strong mediation capabilities.

At ALCIS, we like it precise, accurate, and reliable but also colorful, diverse, creative and even, when necessary, disruptive. The ALCIS team and all our external experts build on a large variety of expertise, origins, cultures, languages, and horizons. This diversity is the strength of our boutique to help our clients move forward, even in territories previously unknown to them.

At ALCIS, we like it precise, accurate, and reliable but also colorful, diverse, creative and even, when necessary, disruptive. The ALCIS team and all our external experts build on a large variety of expertise, origins, cultures, languages, and horizons. This diversity is the strength of our boutique to help our clients move forward, even in territories previously unknown to them.

Our Values

Clients first

Trusted independence

Experience and expertise

Think straight, talk straight

Cost-conscious for excellence

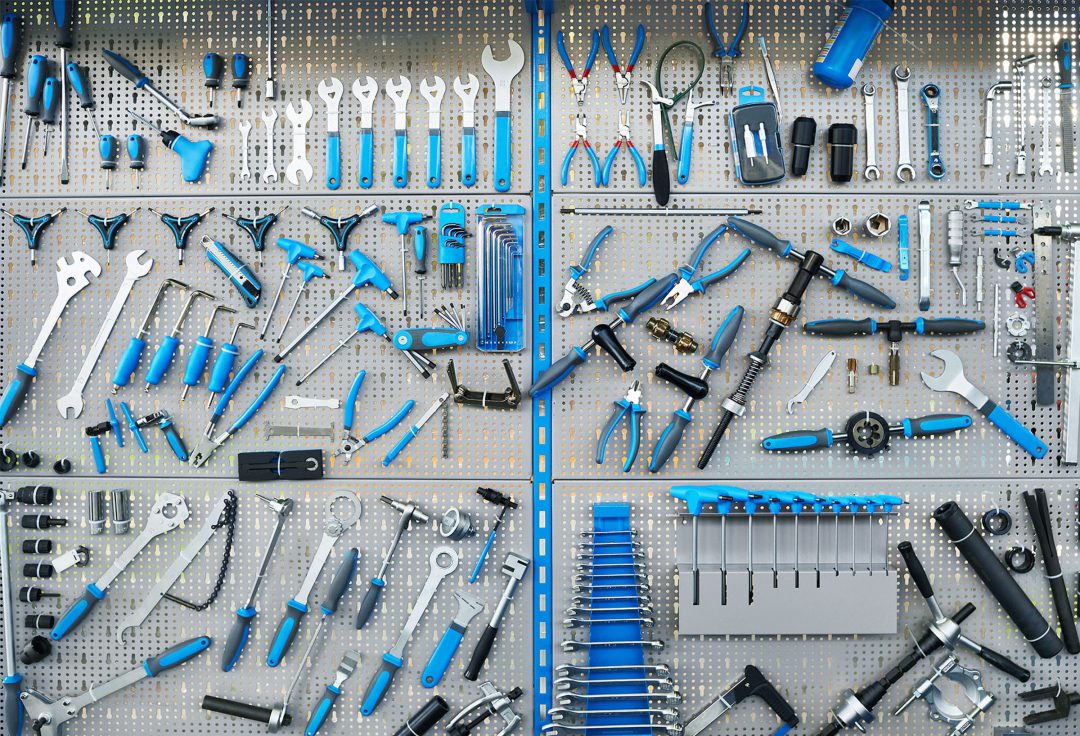

Bandwidth

A powerful set of competences from an extensive expert network

For project-specific needs, the ALCIS team is supported by an extensive international network of experienced legal, technical and industry experts contributing their specialist skills to the project’s success.

For project-specific needs, the ALCIS team is supported by an extensive international network of experienced legal, technical and industry experts contributing their specialist skills to the project’s success.

Clients to date

These companies and government bodies have trusted ALCIS’ founding partners over the years.

Large public companies

Air France-KLM (F/NL)

AIRBUS (D/F)

ALD (F)

Amazon (US)

BAM (NL)

Bouygues (F)

Deutsche Post DHL (D)

Deutsche Telekom (D)

E.ON (D)

Eiffage (F)

Engie (F)

FedEx (US)

Fraport (D)

GAZPROM (RU)

L3Harris Technologies (US)

Honeywell (US)

HT (HR)

Kühne+Nagel (CH)

LKQ (US)

London Stock Exchange (UK)

Lufthansa (D)

Merck (D)

Meta (Facebook) (US)

METRO (D)

Philip Morris (US)

Rakuten (J)

RWE (D)

Suez (F)

Veolia (F)

Vinci (F)

ZF Friedrichshafen (D)Medium-sized companies (private or government-owned)

ABELLIO (D)

amedes (D)

avantum (D)

Berlin Airports (D)

CashPoint (M)

DALKIA (F)

DeCrane Aircraft (US)

Deutsche Bahn (D)

Duales System Deutschland (D)

Duesseldorf Airport (D)

EDF Energies Nouvelles (F)

Gauselmann (D)

Giraud (F)

Herder (D)

Hoyer (D)

INTOCAST (D)

IVU Traffic Technologies (D)

Jahr & Achterfeld (D)

KEOLIS (F)

Knauf (D)

Lerbs (D)

Local Motors (US)

MGM/OZV (CH/D)

Munich Airport (D)

Newham Consortium (EU)

Novomatic (A)

Remondis (D)

RLC (D)

SEA Milano Airports (I)

Stahlgruber (D)

t+d (D)

Schwarz (D)

Swiss Post (CH)

TOBIS (D)

TWI (CH/US)

Vanguard (D)

WestSpiel (D)Financial institutions, PE investors, investment funds

Allianz Capital (D)

Ardian (AXA PE) (F)

Aurelius (D)

CSFB Real Estate (UK)

EQT (D)

CUBE Infrastructure (F/L)

Pirelli Real Estate (I/D)

RREEF (UK/D)

STAR Capital (UK)

Caisse des Dépôts (F)

HELABA (D)

HSH Nordbank (D)

KfW (D)

LBBW (D)

NATIXIS (F)

NordLB (D)

NRW.Bank (D)

R12 (S)

SachsenLB (D)

Sparkasse Köln/Bonn (D)

WestLB (D)Government and regulatory authorities

DG COMP - EU Commission

Federal Trade Commission (USA)

Autorité de la concurrence (F)

Bundeskartellamt (D)

CCCS (Singapore)

Bundeswettbewerbsbehörde (A)

Agence des Participations de l’Etat (F)

Caisse des Dépôts et Consignations (F)

BAnstPT (D)

Treuhandanstalt (D)

Government of Liechtenstein

Government of Romania

Ministries of Finance (D, CH, HR)

Ministry of Defence (CZ)

Ministry of Post & Telecom Services (D)

Regional government of North Rhine- Westphalia (D)

Regional government of Lower Saxony (D)

Regional government of Rhineland-Palatinate (D)

Regional government of Saxony-Anhalt (D)

Regional government of Thuringia (D)

Municipality of Kassel (D)

Municipality of Milan (I)